For those who do not know, Nicholas Kristof is an incurable optimist who writes a column for the New York Times on aid, development, foreign policy, and all things related. In a video posted to his blog, he took questions from readers. The author of one development blog point out that most of Kristof’s articles follow a standard narrative that: “one that often focused on the foreign, typically American “savior” helping the poor Africans in need, to the exclusion of efforts of black Africans themselves to bring about change on the ground.” It is a good question, since most of the development workers in this world making things happen are locals, not foreigners. Here is Mr. Kristof’s response:

For those who do not know, Nicholas Kristof is an incurable optimist who writes a column for the New York Times on aid, development, foreign policy, and all things related. In a video posted to his blog, he took questions from readers. The author of one development blog point out that most of Kristof’s articles follow a standard narrative that: “one that often focused on the foreign, typically American “savior” helping the poor Africans in need, to the exclusion of efforts of black Africans themselves to bring about change on the ground.” It is a good question, since most of the development workers in this world making things happen are locals, not foreigners. Here is Mr. Kristof’s response:

I do take your point. That very often I do go to developing countries where local people are doing extraordinary work, and instead I tend to focus on some foreigner, often some American, who’s doing something there.

And let me tell you why I do that. The problem that I face — my challenge as a writer — in trying to get readers to care about something like Eastern Congo, is that frankly, the moment a reader sees that I’m writing about Central Africa, for an awful lot of them, that’s the moment to turn the page. It’s very hard to get people to care about distant crises like that.

One way of getting people to read at least a few paragraphs in is to have some kind of a foreign protagonist, some American who they can identify with as a bridge character.

And so if this is a way I can get people to care about foreign countries, to read about them, ideally, to get a little bit more involved, then I plead guilty.

I think this is a pretty thoughtful and right-on response. Continue reading →

For decades, the Western world has viewed Africa as a basket case in need of charity, giving huge amounts of aid to corrupt dictators who steal much of the money and squander the rest. Critics of aid say it creates dependence, undermines the competitiveness of local industries, and keeps cruel dictators in power by giving them the financial wherewithal to secure their position. Aid is a $40 billion a year business in Africa, and there isn’t too much to show for it.

For decades, the Western world has viewed Africa as a basket case in need of charity, giving huge amounts of aid to corrupt dictators who steal much of the money and squander the rest. Critics of aid say it creates dependence, undermines the competitiveness of local industries, and keeps cruel dictators in power by giving them the financial wherewithal to secure their position. Aid is a $40 billion a year business in Africa, and there isn’t too much to show for it.

A month ago I got cable television for the first time in 8 months so that I could watch the World Cup, which airs in the Philippines at 2:30 AM. And lately, I find myself stopping at Daystar – “faith-based TV for today’s generation” – for a lot of different reasons. For one thing, it is difficult to comprehend just how easy it is for these guys to ask for huge amounts of money. For another, whenever I see these guys I can’t help but think of

A month ago I got cable television for the first time in 8 months so that I could watch the World Cup, which airs in the Philippines at 2:30 AM. And lately, I find myself stopping at Daystar – “faith-based TV for today’s generation” – for a lot of different reasons. For one thing, it is difficult to comprehend just how easy it is for these guys to ask for huge amounts of money. For another, whenever I see these guys I can’t help but think of

The turritopsis nutricula species of jellyfish

The turritopsis nutricula species of jellyfish

The narrative of microfinance reads that it provides money to the poor to start businesses and, in doing so, lift themselves out of poverty. The idea that everyone is an entrepreneur plays into this understanding of microfinance. Perhaps the leading beneficiary of this narrative is my former employer, Kiva since people generally like the idea of empowering these proto-entrepreneurs to go out and change their situation. People struggle to make an impact in their approach to philanthropy, but microfinance and Kiva specifically allows them to be a mini-venture capital firm. But this narrative is, at least, an oversimplification of the reality on the ground.

The narrative of microfinance reads that it provides money to the poor to start businesses and, in doing so, lift themselves out of poverty. The idea that everyone is an entrepreneur plays into this understanding of microfinance. Perhaps the leading beneficiary of this narrative is my former employer, Kiva since people generally like the idea of empowering these proto-entrepreneurs to go out and change their situation. People struggle to make an impact in their approach to philanthropy, but microfinance and Kiva specifically allows them to be a mini-venture capital firm. But this narrative is, at least, an oversimplification of the reality on the ground. The masters of war of late never seem to be the ones actually doing the fighting. In fact, most of them have never fought, ever. George W. Bush, Dick Cheney, Karl Rove,

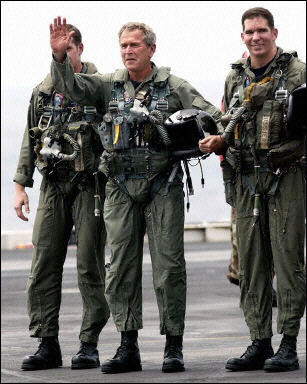

The masters of war of late never seem to be the ones actually doing the fighting. In fact, most of them have never fought, ever. George W. Bush, Dick Cheney, Karl Rove,