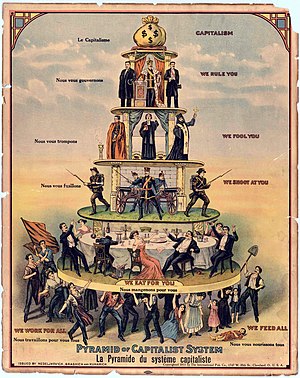

The other day a friend put me in touch with a friend of his who had just moved to Accra. She works the Acumen Fund, a social venture capital fund that invests in promising entrepreneurs in developing countries. The use of the adjective “social” is a bit misleading, in the sense that the companies are purely for-profit and do not need to have an explicit social motive guiding the business strategy. What distinguishes them is the market they serve, termed the base of the pyramid, or BoP for short. The name is derived from C.K. Prahalad’s books “Fortune at the Bottom of the Pyramid.” These businesses typically serve the poor in some way. Acumen has invested in agribusinesses and businesses in healthcare, water, and energy. The broader term for the modus operandi of Acumen Fund and other investment funds is “impact investing.” The unfailingly reliable Wikipedia describes impact investing as “an investment strategy whereby an investor proactively seeks to place capital in businesses that can generate financial returns as well as an intentional social and/or environmental goal.” It is a relatively new concept, and it has taken off in recent years.

The other day a friend put me in touch with a friend of his who had just moved to Accra. She works the Acumen Fund, a social venture capital fund that invests in promising entrepreneurs in developing countries. The use of the adjective “social” is a bit misleading, in the sense that the companies are purely for-profit and do not need to have an explicit social motive guiding the business strategy. What distinguishes them is the market they serve, termed the base of the pyramid, or BoP for short. The name is derived from C.K. Prahalad’s books “Fortune at the Bottom of the Pyramid.” These businesses typically serve the poor in some way. Acumen has invested in agribusinesses and businesses in healthcare, water, and energy. The broader term for the modus operandi of Acumen Fund and other investment funds is “impact investing.” The unfailingly reliable Wikipedia describes impact investing as “an investment strategy whereby an investor proactively seeks to place capital in businesses that can generate financial returns as well as an intentional social and/or environmental goal.” It is a relatively new concept, and it has taken off in recent years.

So we met up at one of the many Lebanese restaurants in town for a drink and talked about all things development. There aren’t too many impact investors operating in Ghana, or West Africa in general. A few local private equity firms and some U.S.-based venture capital funds are the only ones I have come across. But it is the next big thing in development, which, in general, tends to driven by fads and has an often-changing flavor of the month. For a few years, microfinance was the darling of the donor communities, as Dr. Muhammad Yunus took that Nobel Peace Prize and ran with it. But now, microfinance is experiencing its own serious growth pains in its biggest and most dynamic market, India, and has been criticized for being, at best, ineffective, and, at worst, actively counterproductive in alleviating poverty.

It is too soon to determine whether the torch has been formally passed (I am of the opinion that microfinance is going through an identity crisis and will become a more mature industry as it sorts out what it is trying to be and what it can do). But the microfinance revolution set in motion a change in thinking. There is a lingering sense among people in the development community that the Western aid apparatus does not work. Some like to say it is broken, but that implies that it was ever anything but broken. Decades of food aid and mandated economic liberalizations and giving tractors away to farmer for free have all contributed to a private sector that is atrophied and unable to produce sustainable growth. The logic goes like this. NGO comes to Ghana and gives away 100 tractors to rural farmer groups. The NGO project lasts three years before the funding runs out and the NGO closes its office and goes home. The next year the tractor breaks down. Unfortunately, because the only tractor dealership in town was put out of business when the NGO came in and started giving away tractors for free, there is no one to repair the tractor. So it sits in the field gathering rust while the farmers are back to square one. Buying a new tractor is out of the question, since the tractor dealership is gone. The end result of the intervention is an agriculture sector that is worse off than it was when the NGO came in the first place.

It is too soon to determine whether the torch has been formally passed (I am of the opinion that microfinance is going through an identity crisis and will become a more mature industry as it sorts out what it is trying to be and what it can do). But the microfinance revolution set in motion a change in thinking. There is a lingering sense among people in the development community that the Western aid apparatus does not work. Some like to say it is broken, but that implies that it was ever anything but broken. Decades of food aid and mandated economic liberalizations and giving tractors away to farmer for free have all contributed to a private sector that is atrophied and unable to produce sustainable growth. The logic goes like this. NGO comes to Ghana and gives away 100 tractors to rural farmer groups. The NGO project lasts three years before the funding runs out and the NGO closes its office and goes home. The next year the tractor breaks down. Unfortunately, because the only tractor dealership in town was put out of business when the NGO came in and started giving away tractors for free, there is no one to repair the tractor. So it sits in the field gathering rust while the farmers are back to square one. Buying a new tractor is out of the question, since the tractor dealership is gone. The end result of the intervention is an agriculture sector that is worse off than it was when the NGO came in the first place.

This cycle continues as the development apparatus takes one step forward and two steps back over and over again (purposefully?). This is the first reason for the shift. The second reason is that there are a lot more private donors in the game right now who are not interested in giving money to programs that don’t work. The Gates Foundation, the Soros Foundation, the Google Foundation, and others have little tolerance for the same miserable inefficiencies that plague government-funded aid projects. They look for proven and, most importantly, sustainable impact for their dollars. And that means acknowledging the reality that, in development, economics and markets are important considerations. Otherwise, you’re just pushing on a string.

In our conversation, I told her I thought that the next five years were going to be huge for impact investing. The Gates-Buffett billionaires challenge is going to bring in major money for development projects. Billionaires tend to be card-carrying capitalists and above-average businessmen, and have gotten to where they are today by making sure that things work as they should. And impact investing has it all. It is profitable, which makes it sustainable. It is effective at targeting the poor within a capitalist system. The whole point of “Fortunate at the Bottom of the Pyramid” is that there is a fortune at the bottom of the pyramid. Two billion people have a lot of purchasing power.

This was my hypothesis. Then I saw this article:

Giants in philanthropy and wealth circles, such as the Rockefeller and Gates foundations, have taken impact investing by the horns and are launching investment programs. Funds are being devised. Assets in the sector, currently estimated at $50 billion, are expected to grow to $500 billion over the next three years.

$50 to $500 billion. That is roughly equal to growth of 300% per year. So, once again, Develop Economies is right. Son of Jor-El, kneel before Zod!

Exactly. Impact investing implemented well makes up for where traditional philanthropy, traditional financing, and the MFIs of today fall short. As you explained, the traditional philanthropy model of grant-making is short-sighted…’nuff said. Traditional financing is also relatively short-sighted, unwilling to wait for the slower (but not necessarily smaller) returns gained from loaning to ‘social’ businesses. And MFIs, as an industry, do not have the incentive structures to scale all the business ideas they intend to while making the returns they seek.

Why I think impact investing has the best chance is because there is more organic accountability and incentives for high performance. Entrepreneurs and other small business owners have an idea and want to make money, but need capital and often times, business acumen to scale. Traditional grant-makers typically do not see the money they grant again, with each dollar they give having a finite, often short-lived lifespan; however, they aim to make their money go farther and have deeper, more sustainable impact. With impact investing, the entrepreneur is incented not by the fear of what could happen if s/he does return the money to the loan shark, but instead, by the collective success of his or her business, suppliers, customers, and investors. The traditional grant-makers, likewise, are incented to vet great ideas and provide not just the capital, but the metrics, the network, and the advice to help it grow. The result is clear – more returns for everybody. Simply put, it’s a market-based approach, not a handout.

Acumen Fund, as you mentioned, is a front runner in this area and has done a great job paving the way for many entrepreneurs. I’ve also been following Ashoka and its Full Economic Citizenship arm that is based on the idea of creating a ‘hybrid value chain’ where scale is reached through cross-sector collaboration. You can read more about it here: http://fec.ashoka.org/

Can’t help but think that it all sounds too good to be true. Impact investing like microfinance hinges on one key factor that I don’t think gets enough attention: that there is a massive pool of great businesses that are waiting to take off.

I like introducing the accountability of the private equity world, but I’m skeptical of how many accountable SMEs exist to effectively soak up $500 billion and grow it.

My two cents: you’re better off putting that $500 billion towards building a better-educated youth that will have the capacity to start and run businesses.