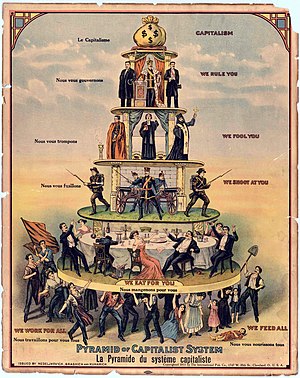

The other day a friend put me in touch with a friend of his who had just moved to Accra. She works the Acumen Fund, a social venture capital fund that invests in promising entrepreneurs in developing countries. The use of the adjective “social” is a bit misleading, in the sense that the companies are purely for-profit and do not need to have an explicit social motive guiding the business strategy. What distinguishes them is the market they serve, termed the base of the pyramid, or BoP for short. The name is derived from C.K. Prahalad’s books “Fortune at the Bottom of the Pyramid.” These businesses typically serve the poor in some way. Acumen has invested in agribusinesses and businesses in healthcare, water, and energy. The broader term for the modus operandi of Acumen Fund and other investment funds is “impact investing.” The unfailingly reliable Wikipedia describes impact investing as “an investment strategy whereby an investor proactively seeks to place capital in businesses that can generate financial returns as well as an intentional social and/or environmental goal.” It is a relatively new concept, and it has taken off in recent years.

The other day a friend put me in touch with a friend of his who had just moved to Accra. She works the Acumen Fund, a social venture capital fund that invests in promising entrepreneurs in developing countries. The use of the adjective “social” is a bit misleading, in the sense that the companies are purely for-profit and do not need to have an explicit social motive guiding the business strategy. What distinguishes them is the market they serve, termed the base of the pyramid, or BoP for short. The name is derived from C.K. Prahalad’s books “Fortune at the Bottom of the Pyramid.” These businesses typically serve the poor in some way. Acumen has invested in agribusinesses and businesses in healthcare, water, and energy. The broader term for the modus operandi of Acumen Fund and other investment funds is “impact investing.” The unfailingly reliable Wikipedia describes impact investing as “an investment strategy whereby an investor proactively seeks to place capital in businesses that can generate financial returns as well as an intentional social and/or environmental goal.” It is a relatively new concept, and it has taken off in recent years.

So we met up at one of the many Lebanese restaurants in town for a drink and talked about all things development. There aren’t too many impact investors operating in Ghana, or West Africa in general. A few local private equity firms and some U.S.-based venture capital funds are the only ones I have come across. But it is the next big thing in development, which, in general, tends to driven by fads and has an often-changing flavor of the month. For a few years, microfinance was the darling of the donor communities, as Dr. Muhammad Yunus took that Nobel Peace Prize and ran with it. But now, microfinance is experiencing its own serious growth pains in its biggest and most dynamic market, India, and has been criticized for being, at best, ineffective, and, at worst, actively counterproductive in alleviating poverty. Continue reading