On December 3rd, 2014, I flew to Nepal by way of Istanbul for a wedding in Kathmandu. I’d spent the last week writing papers and preparing to leave school a week early for the trip. My flight was at 11 PM, so I had to leave for airport at 9. The Lonely Planet guides for Nepal and India I’d ordered the day before arrived at 4 in the afternoon, but I missed getting my new Capital One card with no foreign exchange fees by an hour. I grabbed the blue backpack that I carried for three years around Southeast Asia and Africa, which was filled with mostly cheap t-shirts and jeans that I wouldn’t mind jettisoning if I needed extra room, plus one pair of all-purpose dress clothes for the four-day wedding I would be attending, and took the red line to Logan Airport.

Being a Wednesday at 9:30, I breezed through security, found my gate at the international terminal, and ordered a whiskey on the rocks at the airport bar to pass the time until my flight. I’ve written about my affinity for airport bars on this blog. There is something about sitting at a cookie-cutter bar, listening to the boarding calls, and watching people come and go that brings you back to all the airports where you’ve done the exact same thing and makes you excited to head back out on the road. A half-hour later, my friend Jeff showed up and we ordered another drink. A man next to us tried to strike up a conversation. He was heading to Mumbai, and had spent a few years teaching English in China and Thailand, which we both took as a cue about the purpose of this man’s travels. After he yelled at us for some perceived slight, we finished our drinks and headed to the gate.

With the exception of the meal, the flight was long and uneventful. When I booked my ticket, I must not have been paying attention, because I thought I was required to select a meal option and chose the “bland meal”, which I took to be the default option. Of course, the bland meal is not the default option and is as bad as its name would imply. It consists of a piece of white chicken with no sauce of any kind, with a side of steamed spinach. When the stewardess on Turkish Airlines brought it to me, I was devastated. Fortunately, I was able to trade up for a regular meal, but only after everyone was served.

We arrived in Istanbul after a 10-hour flight to find that our connection was delayed, so we spent the next few hours playing the first of the many games of Uno that would be played over the next month. I’d bought it for another trip, and discovered that it is really the Cadillac of travel games. Gin rummy and spades are great two- and four-player games, respectively, but they can be hard to teach to someone who’s never played. Yahtzee, which I picked up when I visited two of my friends in Buenos Aires after college, is another excellent way to while away the hours with people, but one game takes a long time and requires a pen, paper, five dice, and a good rolling surface. Uno, on the other hand, is easy to learn and requires only an Uno deck. It is complex enough to not be stupid, but simple enough to let conversation take precedence over game play. And, given that a good travel game is merely the vehicle for the experience rather than an end in itself, Uno is among the best I’ve found.

Fast forward four hours and we are boarding again. By this point, we’d rendezvoused with Aditya, another friend of Ashaya, whose wedding we were all going to attend. We knew that Ellie and Adea, two of Ashaya’s friends from her time at the World Bank who we’d never met before, were on the same flight to Nepal, so we began playing rocks, paper, scissors to see which of us would approach random pairs of girls who seemed sufficiently socially-conscious and erudite to be Ashaya’s friends and ask them if they were by chance heading to a wedding in Kathmandu. Jeff lost, and the first one turned out to be a case of mistaken identity, so we chalked it up to a lost cause. When we finally boarded, two girls pointed at us and asked if we were heading to Ashaya’s wedding. With the five of us aboard, we settled in for a 7-hour trip aboard a quarter-filled plane. I traded in my second bland meal for the chicken, stretched out across four seats, and slept the rest of the way to Kathmandu.

When we landed at 11 in the morning, we were greeted by Kamal Rana, Ashaya’s uncle and an employee of Nepal Airlines who worked at the airport. He took our passports, led us through the VIP lane of customs and immigration, brought a porter to take our bags, and took us to the van that would take us to our hotel. This was the first of four encounters with Mr. Rana, who shepherded me through Tribhuvan International Airport in a fraction of the time it took the rest of the poor, friendless masses.

Ashaya put us up at the Shanker Hotel, formerly a palace located in the heart of the city. The place had a lot of character, with old unique rooms, a bar called the Kunti Bar, and killer pool bar surrounded by a grassy field. After dropping off our stuff, Jeff and I headed out to try to meet with a few of our friends, but missed them by a few minutes. Without a cell phone or Internet, finding your friends in downtown Kathmandu is next to impossible, so we found an upscale lounge bar on Durbar Marg called Mezze by Roadhouse, ordered an Everest beer, and used the wifi to discover that our friends had gone to a store called Monalisa Textiles to pick up kurtas for the formal event the next day and had already left for Ashaya’s house. So we went the same store, bought our kurtas, and went back to the hotel to freshen up and head to Ashaya’s house to catch the tail-end of the mehendi ceremony and meet our friends.

The house – located in an area referred to as Bhatbateni, after the eponymous supermarket – is beautiful. Bustling with 20-30 workers and a full band, and decorated with brown and orange colors and icons designed by Ashaya of two elephants holding a heart, the place was a beehive of activity. After 24 hours of travel, it was nice to finally see Ashaya and the rest of the crew, who were busy getting their mehendi tattoos – floral patterns for the ladies, the image of Ganesh for the men. I respectfully declined, though in retrospect, it was probably a mistake.

With four hours to kill between the ceremony and the party, we all went back to nap before grabbing a drink at the Kunti Bar. Aditya wore a white linen suit straight out of Miami Vice, and I had on my all-purpose blazer and slacks. Everyone else wore their kurtas and saris, as white people are wont to do at traditional South Asian wedding events. We were joined by the rest of our Shanker crew – Graham, Yscaira, and Kaia. After making the van wait for an hour, we finally piled in and left for the party.

The party was in full-swing when we arrived. With two fully-stocked open bars, a military band playing jazz songs, and several hundred people milling around, I set about to get a drink. We were told by our friends that we would need to perform a dance on stage when the bride is introduced. “Just follow what she does,” I was told. At that point, I decided I wanted no part in this, ordered a Ballantine scotch on the rocks, and convinced Jeff to hang back with me while the rest of our friends made fools of themselves on stage in front of 200 Nepalis.

Eventually, the combination of an open bar with a never-ending supply of Ballantine and aggressive peer-pressuring by Brandon, the husband of one of Ashaya’s friends, got the better of me, and I wound up in rough shape back at the Kunti Bar, where we were all playing a terrible drinking game called Ibble Dibble, which sent me on a downward spiral that was fortunately cushioned by my bed two floors up.

The next day was the first of the main wedding ceremonies. The groom’s family comes to the bride’s house, where an engagement takes place, followed by the actual wedding. We headed over to the house for gift-giving ceremony and watched as people streamed onto a stage with two couches for the couple to present them with gifts. After a hearty lunch of Nepali food, we headed back to the hotel to spend the rest of the afternoon at the pool bar at the Shanker.

As a rule of thumb, when you leave Boston in December for a landlocked city that is 75 degrees and sunny and stay in a hotel with a pool bar, you not only try to maximize your time there, you do things to make it seem even more ridiculous than it is. To that end, I ordered a Singapore Sling – my go-to pool-bar drink, after Hunter S. Thompson ordered one at the Polo Lounge in Fear and Loathing in Las Vegas – put on a playlist created by a friend called “Sexy 80’s Pool Party”, and broke out the Uno deck. A few drinks later, the rest of the crew showed up in their saris and kurtas, so I headed back to get ready before leaving for the party.

The second night turned out to be as lively as the first, with an open bar and several hundred people milling around the compound, drinking scotch and mulled wine, watching a slideshow of Ashaya and her friends through the years, and listening to the band and DJ. One of the uncles – colloquially referred to as “Crazy Uncle”, who I subsequently found out was the CEO of the largest steel company in Nepal – saw that the young folks were fading, and took it upon himself to take shots with everyone and tell the DJ to put on pop music and create a dance party, which took the party to another level. At midnight, another wedding ceremony began, with the parents of the bride washing the feet of the couple, to the soundtrack of “Timber” by Pitbull.

We had most of the following day free to check out Kathmandu and the surrounding area. The Shanker crew piled into two cabs and headed first to Durbar Square, where we wandered the streets, dipped into shops to look at fabrics and gurkha knives, walking down narrow alleys that opened up into huge squares with Buddhist stupas and Hindu temples sprinkled everywhere. The buildings are old and rundown, with brightly painted doors and chipped paint. Street dogs are everywhere, and sacred cows wander around, doing whatever they please.

While tame in comparison Indian cities, Kathmandu is a chaotic place. With few perceivable driving or walking rules, the streets are polluted and loud, as drivers honk anytime a person or animal ventures close to the car. Vendors sell everything from jewelry to raw fabrics, silver pots to knives, art, trinkets, and more. Inlaid statues of Ganesh and other Hindu gods are tucked between old doors and alleyways, and passing pedestrians will briefly pray at the shrine before ringing a bell and moving on. Not dissimilar from other big cities in developing countries, like Bangkok, Manila, Phnom Phen, or Accra, it is best described as ordered chaos.

One fascinating part of Durbar Square is the house of the Royal Kumari, known as the Kumari Ghar. In Nepali culture, the kumari is the tradition of worshiping young pre-pubescent girls as manifestations of the divine female energy or devi in Hindu religious traditions. She is selected through a rigorous process from a particular caste, and must have perfect features, which have quite poetic descriptions, such as a neck like a conch, a body like a banyan tree, a chest like a lion, and a voice as soft and clear as as duck’s. The philosophical basis for her existence is seriously heady:

“The worship of the goddess in a young girl represents the worship of divine consciousness spread all over the creation. As the supreme goddess is thought to have manifested this entire cosmos out of her womb she exists equally in animate as well as inanimate objects. While worship of an idol represents the worship and recognition of supreme through inanimate materials, worship of a human represents veneration and recognition of the same supreme in conscious beings.”

The Kumari comes to the window of her palace, to which she is confined until she reaches puberty, once a day to allow visitors to view her. We waited for a half hour to catch a glimpse of the living goddess, but unfortunately, like the elusive snow leopard, she never showed. So, content with the fact that we almost saw a living goddess and having mixed feelings about perpetuating an arguably exploitative, anachronistic tradition, we searched for the highest possible bar we could find to regroup, have a drink, play Uno, and plan the next move.

Once we had our fill of tourism for the day, we headed back to Ashaya’s house for another key part of the wedding ceremony, when the bride is ceremonially led around a structure built specially for the occasion, and is taken to a horse-drawn chariot with the husband to leave for the house of the groom, where she will stay for the rest of the ceremony. During this ceremony, the women cry as she is led from the home for the last time (ceremonially), and the band plays a loud and, at least to these western ears, eerie repetitive song. The two prominent instruments are a nadaswaram, which is a kind of non-brass horn that has a tinny sound like a muted trumpet that you might see a snake charmer play, and a sringa, which is a giant semi-circular horn that you’d find in an old James Bond movie and is blown loudly over and over again. We watched as the chariot took off and the procession followed them to the house of the groom’s uncle, who hosted the groom’s party, since the groom’s family lives in Baltimore and doesn’t have property in Kathmandu.

That night we headed to another party at the groom’s family’s house. By this point, two days of wedding parties and sightseeing and a 12-hour time difference were beginning to take its toll on me and my friends, and the spirit that drove the first two nights had largely subsided. Fortunately, when we got to the party, we were greeted by a much more subdued party and “The Essential Kenny G” playing, on repeat, all the way through. I had a brief moment when I thought to myself, “Is this the Kenny G version of ‘My Heart Will Go On?’” The answer was yes, so I made a mental note that that was a funny music choice, and moved on to the bar. The night ended early for us, and we crashed early.

The next morning we headed to the Boudhanath Stupa, referred to as the “monkey temple” after its simian inhabitants. The climb to the top was treacherous, with twenty flights of steps leading to the top of a large hill at the outskirts of Kathmandu. The temple is certainly impressive. It is one of the largest ancient Buddhist stupas in the world, and it dominates the skyline. It was built in the 8th century AD by the Tibetan emperor Trison Detsan, along a trade route between Tibet and Nepal, serving as a resting place for many Tibetans who traveled through and, in the 1950s, the neighborhood of choice for Tibetan refugees seeking asylum in the country.

After spending an hour exploring the stupa and checking out the shops, we headed to another Durbar Square in a smaller city called Patan. This was my favorite part of the Kathmandu Valley. With old brown buildings built in the 1600s by Newari kings, the Patan Durbar Square is beautiful and clearly rich with history and culture. We lazily explored the square for an hour, before finding a place to sit and plan the next move. We jumped into two cabs and headed back to Thamel Square, the beating heart of Kathmandu, to check out a few shops and head back to the hotel to prepare for the final party of the four-day event.

When we arrived at the Officers Club of the Nepali army, I looked around at a party of 1,200 people and thought to myself, “Wow, this is a big party”. There were bars everywhere, and a buffet line that made me wish I hadn’t eaten that day so that I could take advantage of the Indian, Nepali, Chinese, and Italian food that was there in abundance. Almost as soon as we got there, the party started winding down, so we headed back to the hotel, where we threw an impromptu party for Ashaya and her new husband.

In the morning everyone said their respective goodbyes as we all went on to the next legs of our journeys. Ellie, Adea, and I were driving up to Pokhara, a lakeside town at the foot of the Annapurna range in the Himalayas that was 7 hours to the north. Jeff, Graham, and Yscaira had another day before flying out, and everyone else was set to leave that day. Four days and a lot of ceremonies later, the next chapter began.

Develop Economies’ Music Recommendation

When I moved to Nairobi, I did not really know what to expect. I’d been here once before and moved on a whim. Fortunately, in the first week, I discovered the

When I moved to Nairobi, I did not really know what to expect. I’d been here once before and moved on a whim. Fortunately, in the first week, I discovered the  I actually think that these principles are not only intuitive, but really fundamental to solving any problems. In a social innovation context, the most basic example of how design thinking is not applied is in stereotypical top-down development projects that seek to apply theoretical generalities in addressing a problem, while ignoring the local context. Some might claim that

I actually think that these principles are not only intuitive, but really fundamental to solving any problems. In a social innovation context, the most basic example of how design thinking is not applied is in stereotypical top-down development projects that seek to apply theoretical generalities in addressing a problem, while ignoring the local context. Some might claim that

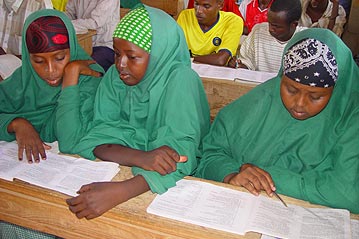

For the last six months, I have been working for a chain of low-cost private primary schools serving low-income and slum communities. The business model is innovative – by standardizing as much of the practice of building and operating a school as possible, Bridge has essentially created a “school in a box.” This is my first experience working in education, so the learning curve, as always, has been steep. But the world is complex and the systems that govern it are highly interconnected. And, as with philosophy and math, the root cause of so many problems can be traced back to education.

For the last six months, I have been working for a chain of low-cost private primary schools serving low-income and slum communities. The business model is innovative – by standardizing as much of the practice of building and operating a school as possible, Bridge has essentially created a “school in a box.” This is my first experience working in education, so the learning curve, as always, has been steep. But the world is complex and the systems that govern it are highly interconnected. And, as with philosophy and math, the root cause of so many problems can be traced back to education. Income inequality is rising, and it is rising fast. The Social Security Administration just

Income inequality is rising, and it is rising fast. The Social Security Administration just